When we talk about debt payoff strategies, we often toss around the terms snowball and avalanche. What do globs of frozen precipitation and natural disasters have to do with debt?

Not a lot really, except that they represent the speed of accumulated effort (snowball) and/or the speed of rapid reduction (avalanche) possible when you really focus on paying off your debt. Fun, right?

Did you notice both methods have a speed element? No matter which approach you take, or a combination of approaches, what these strategies have in common is a speedy, predictable timeline in paying down your debts. All it takes is focus and dedication….and then faithful persistence in following the plan.

2 Debt Payoff Strategies

Here’s what the two plans look like:

Snowball

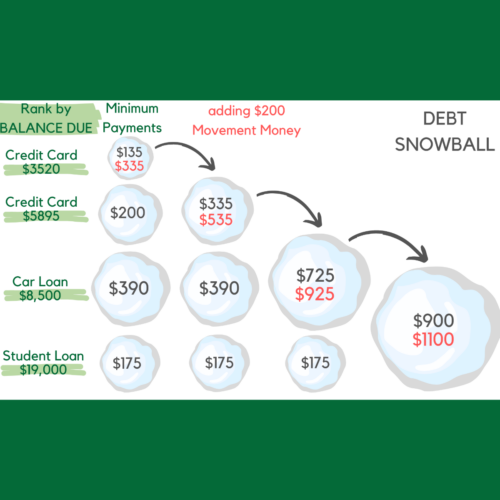

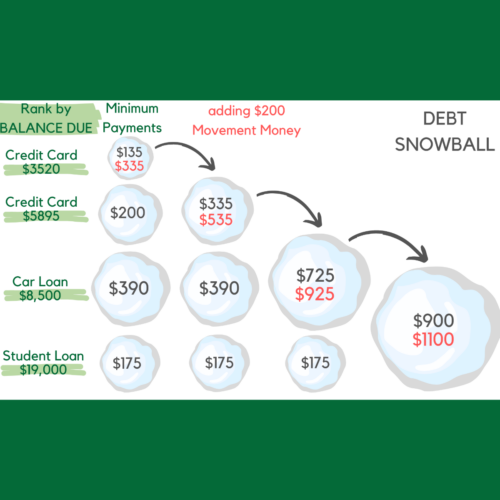

Make a list of all your debts–the balance due, interest rate and minimum monthly payment for each one. Now, sort your debts by the balance due, from smallest to largest. Voila! That’s now the order in which you tackle your debts.

Practically speaking, it looks like this:

You make the minimum monthly payments on all your debts in order to keep them in good standing and preserve your credit score. Then you target the extra money you have each month (here at BCS, we call this Movement Money because it’s the money that’s moving you toward your goals) toward the principle of the smallest debt. Basically you’re paying extra, as much as you can, toward the smallest debt.

When that smallest debt has been paid off, you add that monthly payment plus your Movement Money toward the next smallest debt. When you reach this point, you might even be making what amounts to double payments, with all the extra going toward the principle on your second largest debt…and it will be gone quickly.

When debt #2 is gone, then you roll the amount you were paying on debts #1 and #2 plus your Movement Money toward debt #3. If you’re getting the picture of rapidly increasing monthly payments going after the next and the next and the next debt in order of size, you’re on the right track.

The progress you’ll make will feel amazing!

Avalanche

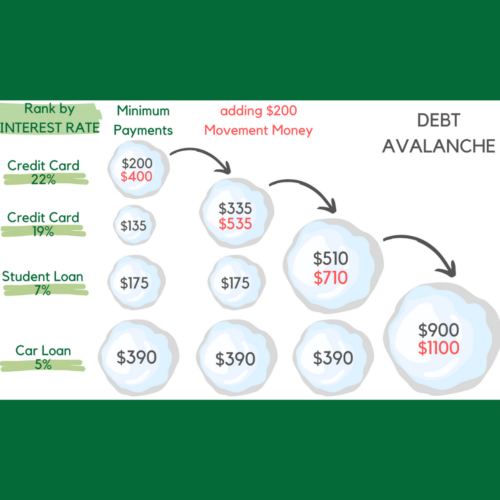

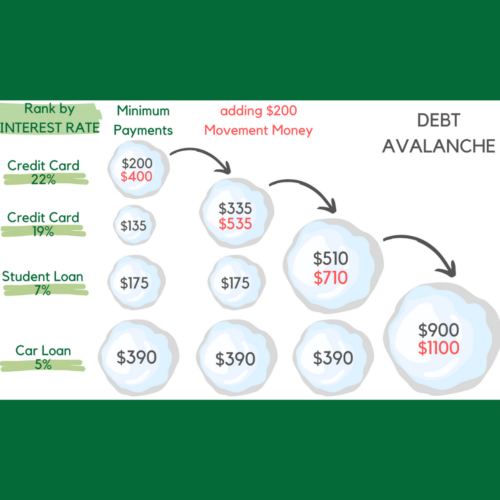

Make a list of all your debts–the balance due, interest rate and minimum monthly payment for each one. Now, sort your debts by the interest rate, from largest to smallest. In this case, you’re going to tackle the highest interest-rate debt first, and doing so will maximize the math in your favor.

Depending on the balances and interest rates of your debts, it might take a little longer to pay off that first debt, if you’re comparing to the snowball method, but the avalanche method always results in your paying the least possible amount of interest across all of your debts.

Time to Decide

So you can decide…will you do best with a quick win? Then the snowball method is for you.

Or are you happiest when you can see the math racking up in your favor? Then proceed with the avalanche method.

You can try crunching the numbers both ways and see how much that psychological win would cost you. It’s very common for the smallest debt balance to be a credit card with the highest interest rate, so sometimes applying the snowball or avalanche methods looks exactly the same for the first debt…and then the paths might diverge.

Time to FOCUS!

A note here about personal loans…

If one or more of your debts is a personal loan from friends or family members and that debt is at 0% or a really low interest rate, you might still choose to tackle this debt first. And that’s okay! Personal loans can sometimes come with relational pressure that goes above and beyond the math, and the relationship is far more important than trimming a few bucks off your bottom line when you’re in debt-payoff mode.

The thing that both the snowball and avalanche methods have in common is focus. You will realize far greater success far faster when you focus all of your Movement Money toward one debt at a time instead of applying it scattershot across several debts.

Once again, it’s important to make the minimum payments on all of your debts if at all possible. But then pick the one debt you’re really going to focus on to pay extra toward. Once you have that debt gone, it frees up space in your budget to roll the payment you were making on the gone debt toward the next debt on your list. This is basically compound math applied in your favor.

Visual exercise:

- Make notes about each of your debts on its own 3×5 card. Include balance due, interest rate, minimum monthly payment.

- Flip each card over and on the back write how you will celebrate when that debt is paid off. Celebration is so very important that you get to build your celebration into your budget…and the amount you’re allowed to spend is the same as that debt’s minimum monthly payment (woohoo!).

- Flip the cards back over so you can see their details. Now arrange them in the order in which you want to tackle them. Will you choose to start with the smallest balance debt (snowball)? Or will you choose the debt with the highest interest rate (avalanche)? Or a hybrid method? It’s up to you!

But you will be thrilled with the debt payoff progress you’ll make if you focus on one debt at a time and then recognize all your hard work with an appropriate form of celebration each time a debt is paid off. Celebrating closes that feedback loop and launches you toward paying down the next debt on your list.

Tina Birch

Tina, one of Birch’s financial literacy counselors, meets regularly with our participants to discuss how to make progress toward their financial goals. She loves taking a values-driven approach to decision-making and stewardship. She is also an avid reader and writer, so we are excited to have her share her knowledge about financial literacy with us.